Thursday marks the start of the first summit between China and Europe in four years. The need of maintaining communication is stressed by everybody. There will be no tangible outcomes, however.

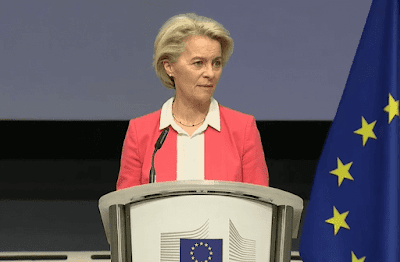

Despite the fact that this Thursday in Beijing will be the first in-person meeting between the two sides in four years, expectations are low when EU Commission President Ursula von der Leyen and Chinese President Xi Jinping, among others, meet. The summit will only be one day long, rather than the two days originally anticipated, and there will not be a unified statement. Hardly anyone is anticipating tangible outcomes. However, it is crucial to keep talking, according to both parties.

A new beginning has been established. Wars have broken out once again in Europe. The Chinese economy is in a precarious state. Business executives and lawmakers are now reporting from Beijing, where the nation has reportedly begun a charm push. Aside from its recent forays into politics, the People’s Republic has been courting businesses and foreign investors since the summer. Some argue that the moment to put pressure on China is now more advantageous than ever before.

For example, the response to the anti-subsidy proceedings that the EU Commission launched against the import of Chinese electric cars due to the country’s “flooded” European market is indicative of the Chinese government’s lack of interest in a confrontation, both behind the scenes and in public.

According to reports in Brussels, the Chinese government is investigating whether or not the subsidies are hurting European business. Beijing views the move as protectionist. Working together is going swimmingly. As part of its sample to analyse the subsidies, the Commission included three Chinese manufacturers: BYD, Geely, and SAIC, headquartered in Shanghai. Since the sample members may anticipate reduced tariffs in the event of a crisis, this development is causing Tesla, a Chinese automaker that sells vehicles to Europe, a great deal of frustration.

But if the EU does implement punitive tariffs—probably about 15%—no one wants to rule out the chance that China may take countermeasures. The committee said that additional politically sensitive industries would likely be targeted by the Chinese if they choose to react. In response to the European Union’s (EU) harsh solar module tariffs, which were abolished in 2014, Beijing launched anti-dumping procedures against European wine. However, there are still a few months to go. The nine-month deadline for the Commission to decide on the imposition of temporary tariffs is rapidly approaching. You have till the beginning of summer to complete the task.

The probe is representative of the EU’s structural trade concerns with China, according to the European Commission. These problems have developed due to subsidy policies and the accumulation of huge surplus capacity in several sectors. China’s electric vehicle, solar power, and wind energy sectors are now world leaders, thanks to the country’s long-term industrial policies and intense rivalry.

Simultaneously, state-owned businesses, especially those with lower levels of competition, are staying in the market even though they would collapse in an ideal market economy. Many are worried that China’s overcapacity may worsen if the country’s economy continues to decline, leading to more exports to Europe and others.

This summit will not live up to the Commission’s expectations. Prior to her visit to Beijing, von der Leyen emphasised China’s responsibility in evading European Union sanctions on Russia and the “imbalance in trade relations” that the EU will no longer abide. There is a threefold difference between Chinese and European exports. Over the last two years, the trade imbalance has increased double, reaching 390 billion euros. The fact that European businesses are not given enough market access by China is a contributing factor.

The Chinese chambers of business are likewise pushing this issue harder and harder. According to Jens Hildebrandt, the chairman of the German Chamber of Commerce in China, they have seen a shift on the horizon: in public bids, Beijing will soon equalise foreign and Chinese enterprises.

According to Brussels, Beijing must determine whether it wants a resolution. That being said, if the EU wants to safeguard its industrial interests, it must use the trade tools it has. All of these issues were covered during the September visit by Trade Commissioner Valdis Dombrovskis. In October, Josep Borrell, the head of EU foreign strategy, visited Beijing.

Risk reduction (de-risking) is likely to be the most delicate subject, second only in sensitivity to political matters like the conflict in Ukraine and the belief that Russian corporations are assisting them in evading sanctions. Reducing the EU’s reliance on China, especially in relation to raw material imports, without decoupling from the nation was previously declared in the spring by von der Leyen. A lot of people bring up the fact that the Chinese have been doing this for a while now.

In Europe, de-risking is happening, but not always in the manner anticipated, according to a Chamber of Commerce poll. Even greater investment was made in China by certain corporations, particularly those in the automobile sector. However, Beijingers are quite sensitive about the matter and try their best to avoid being seen as a threat. It is the belief of some onlookers that they would want things to stay the same for the foreseeable future.

Source: FAZ/Reuters/CGTN

+ There are no comments

Add yours